The First Home Guarantee allows first home buyers with a deposit as low as 5% to qualify for a home loan without paying Lenders Mortgage Insurance (LMI) fees.

Benefits of the Scheme

The primary goal of the FHLDS is to assist Australians in achieving homeownership sooner by reducing deposit requirements and eliminating the need for Lenders Mortgage Insurance (LMI). Typically, a 20% deposit is necessary to avoid substantial LMI fees. However, under the FHLDS, even with a 5% deposit, buyers can sidestep LMI costs as the government guarantees up to 15% of the property’s value.

Expanding Eligibility for 2023-24

Exciting developments are on the horizon for the Home Guarantee Scheme in the upcoming financial year. Effective from 1 July 2023, the eligibility criteria will expand to include

- Joint applications from friends, siblings, and other family groups for both the First Home Guarantee and Regional First Home Buyer Guarantee.

- Non-first-home buyers without property ownership in the last 10 years can also apply.

- Borrowers who are single legal guardians of children – such as their aunts, uncles and grandparents can also apply.

- Australian permanent residents are eligible for all three schemes: First Home Guarantee, Regional First Home Guarantee, and Family Home Guarantee.

Am I Eligible for the First Home Guarantee?

To qualify for the First Home Guarantee, several eligibility criteria must be met:

- A minimum deposit of 5%.

- Australian citizens or permanent residents aged 18 or above with a Medicare card.

- Single first-home buyers with an annual income up to $125,000 or couples earning up to $200,000.

- Applicants must be first-home buyers or those who haven’t owned property in the last 10 years.

- Intention to move into and live in the property as the principal place of residence.

What properties can I buy under the scheme?

- Existing house, townhouse or apartment.

- House and land package

- Vacant land together with separate contract to build a home

- Off-the-plan apartment or townhouse

Once you have been pre-approved, you have 90 days to find and sign a contract of sale for a property.

What Will I Need To Provide To Apply For The First Home Guarantee?

Initially, under the first home buyers scheme, you’ll need to submit the following information to your mortgage broker or to a participating lender.

- Your full name and date of birth;

- Your Medicare number (including your position on the card);

- Your Notice of Assessment (NOA) for your taxable income. For reservations made from 1 July 2023 to 30 June 2024, the relevant NOA is for the 2022-2023 financial year.

- Other standard home loan documents.

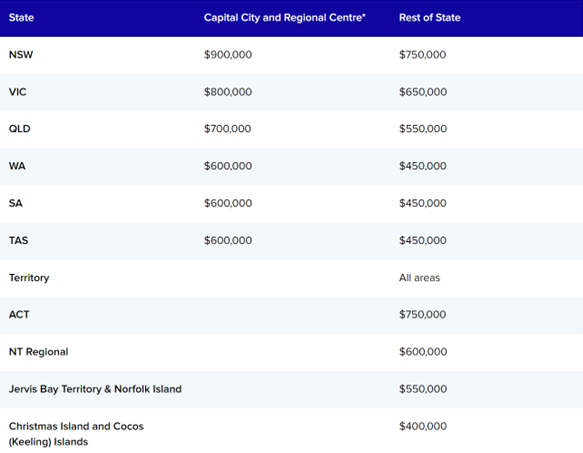

What Are The Price Caps For The First Home Guarantee?

Image sourced from https://www.housingaustralia.gov.au/support-buy-home/property-price-caps

Who Are The First Home Guarantee Lenders?

There are 33 lenders that are currently offering the First Home Guarantee scheme, with a blend of major banks and other lenders too. Some of the major lenders included are –

- Commonwealth Bank

- Westpac

- NAB

- St George

- Bank SA

- Bank of Melbourne

View the full list of 33 lenders here – https://www.housingaustralia.gov.au/participating-lenders

What are the other costs associated with the purchase besides the 5% deposit?

- Stamp duty – $0 (is waived for certain First Home Buyers up to a certain price cap). If you purchase your first home in NSW under $800,000 – you may not need to pay any stamp duty at all.

- Conveyancing costs – $1500 – $2000

- Title searches – circa $300

- Loan fees – can range from $0 – $900.

On average, we can assume on a $500,000 purchase in NSW you will require a 5% deposit of $25,000 + roughly $2700 on average for extra costs. In total – $27,700.

You should also account for other expenses such as building inspections and pest reports too.

You can read up more on the stamp duty exemptions in our previous article First Home Buyer Opportunities – https://cliofinancial.com.au/first-home-buyer-grants-schemes-nsw-2023/

Want to know more information?

Available 7 days – 0422 269 868

Disclaimer: This is general information and should not be taken as financial advice. Please speak to a financial planning professional before making a decision on your home loan.

![Refinance Your Property [2023 Update]](https://cliofinancial.com.au/wp-content/uploads/2023/08/Aventus-Finance-Services-1-400x250.webp)

0 Comments