If you are a first home buyer looking to leap into home ownership, it is important you are as prepared as possible and clear out any of the misconceptions you may have about the property journey.

After chatting to many first home buyers, it is clear the vast majority share the same fears and concerns. Throughout this article I am going to address the 6 most common myths I hear first home buyers talk about.

Myth #1 – It’s a bad time to buy.

I am sure you have heard the saying – ‘The best time to buy real estate was 30 years ago, the second-best time is today’.

It’s important to understand that property is a long-term investment, and speculating what the market could do in 6-12 months is not going to make a significant impact in your return 10 years from now.

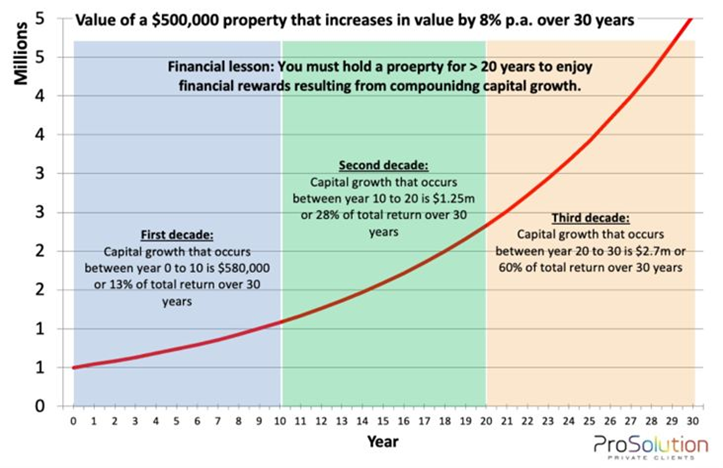

Another great saying is – ‘It’s time in the market, not timing the market’. Below is a great representation of what that quote means.

(Graph from ProSolution)

The above graph essentially shows that to maximise the gain on your property investment, you will see the largest portion of your return made in the third decade of holding. When purchasing property, it is important to assess your current situation today, where you will be in the foreseeable future, and make a judgement based on that.

Myth #2 – You can’t get a home loan if you have HECS/HELP debt.

Banks look at your HECS debt from an angle of how much you are required to pay each year, and this is based off how much you earn. The more you earn, the more you pay back.

For example, if you earn $75,000 per year, then the rough rate of repayment is around 4.50% per year, which is $3,375 taken off your HECS debt.

Lenders will include this in your financial obligations, which depending on how much you owe can hinder your borrowing capacity, but certainly won’t rule you out.

Now, obviously it would be ideal to have no debt when applying for a home loan however that is not often the case. There are still many lenders that will approve you with HECS debt, and that is where choosing the right mortgage broker comes in to play.

If you have any questions surrounding this, feel free to reach out to us as we are more than happy to help.

Myth #3 – You should take a mortgage out with your existing bank.

Just because you have your everyday banking with them, does not mean they have the best solution for your mortgage needs. This is why shopping around and comparing different lenders is crucial before applying for a loan, because each lender has a different policy with different niches that could be much more favourable to you.

Myth #4 – You can’t put down less than a 20% deposit.

Of course, the larger the deposit is always the better. However, times have changed, and recent research suggests that it will take the average Australian 16 years to save for their first house.

Luckily, NSW have some great incentives to get First Home Buyers into the market sooner with a low deposit and avoid paying Lender’s Mortgage Insurance (LMI).

There is opportunity to get into a property valued up to $900,000 with just a 5% deposit. It’s also important to remember stamp duty is exempt for properties up to $800,000, and you only pay a concessional rate from $800,000 – $1,000,000. I have previously done a post outlining the schemes available in NSW in detail – you can have a read of it here.

https://cliofinancial.com.au/first-home-buyer-grants-schemes-nsw-2023/

Myth #5 – You are locked in with that lender for 30 years.

As you progress through your life, your needs, and objectives with change as well. Often, the mortgage product you selected when you first bought your place may no longer be fitting, and you are more than welcome to change.

A good mortgage broker will be able to proactively assess your mortgage facility regularly and look for opportunities to either renegotiate your interest rate or check to see if there is a better option from another lender.

Conclusion.

All in all, education is key when deciding to enter the property market. As a first home buyer, you want to make sure you have the right people around you.

Choosing the right mortgage broker to partner with is crucial to your success in the property game. After all, property is just a game of finance.

If you have any questions or would like to have a chat – please feel free to reach out to me directly.

M: 0422 269 868

![Refinance Your Property [2023 Update]](https://cliofinancial.com.au/wp-content/uploads/2023/08/Aventus-Finance-Services-1-400x250.webp)

0 Comments